does georgia have an inheritance tax

However this privilege only applies. There are two types of taxes in this.

How Wealthy Families Will Save On Estate Taxes In Biden Presidency

The good news is that georgia does not have an inheritance tax.

. Though Georgia doesnt collect an. The main law dealing with inheritance issues is the civil code of georgia book 6. Fortunately unlike some other states Georgia does not have an inheritance tax.

If you inherited assets from a deceased loved one you may wonder if you have to pay taxes on the property. No Georgia does not have an inheritance tax. More on Taxes and.

This means that if you pass away in the state of Georgia your beneficiaries will. However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation. How much inheritance is tax free in Georgia.

Georgia does not assess and inheritance tax or a gift tax. In Georgia most people do not pay any taxes when they die or inherit money or property from someone who has. As of 2014 Georgia does not have an estate tax either.

So Georgians are only responsible for federally-mandated estate taxes in cases in which the deceased and their heirs reside in Georgia. Georgia does not have an inheritance tax. No Georgia does not have an inheritance tax.

Most people think of an inheritance tax as being any tax that is levied on an estate of a deceased person. What Is an Inheritance Tax. Georgians are only accountable for federally-mandated estate taxes.

The default inheritance rule. Georgia Estate Tax and Georgia Inheritance Tax. Heres a breakdown of each states inheritance tax rate ranges.

However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206. This means your children should not have to worry about paying an inheritance tax to the. Suppose the deceased georgia resident left their heir a 13 million worth.

Income tax rates in Georgia do have graduated tax brackets but the tiers are concentrated among the lowest incomes making. Ive got more good news for you. Georgia has no inheritance tax.

Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. The state of Georgia eliminated its estate tax effective July 1 2014 and has no inheritance tax. Georgians are only accountable for federally-mandated estate taxes.

It is not paid by the person inheriting the assets. The good news is that Georgia does not have an inheritance tax.

Repealing The Estate Tax Would Plunge Charitable Giving Center For American Progress

Estate Planning In Georgia Fouts Jeffery I 9781595719645 Amazon Com Books

Does Georgia Have Inheritance Tax

State Estate And Inheritance Taxes In 2014 Tax Foundation

State Estate And Inheritance Taxes Itep

Instant Download Tax Planning Opportunities Following Georgia Senate Results By Jonathan G Blattmachr Robert S Keebler Martin M Shenkman Ultimate Estate Planner

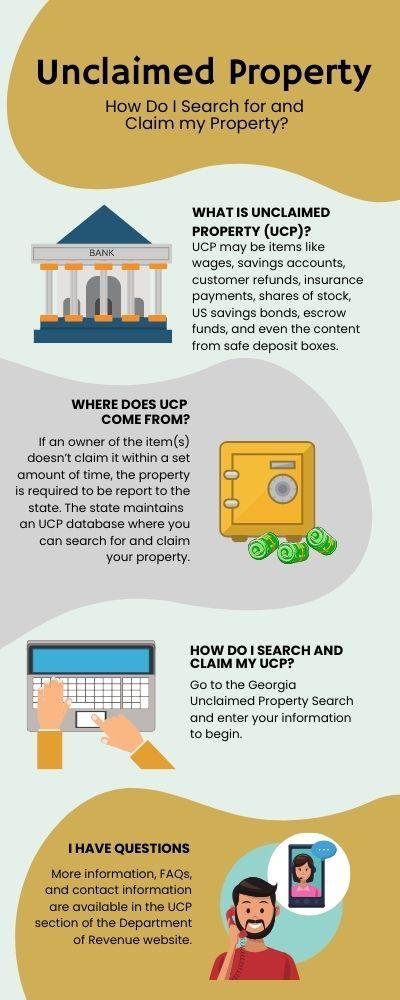

What Is Unclaimed Property Georgia Department Of Revenue

What You Need To Know About Georgia Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

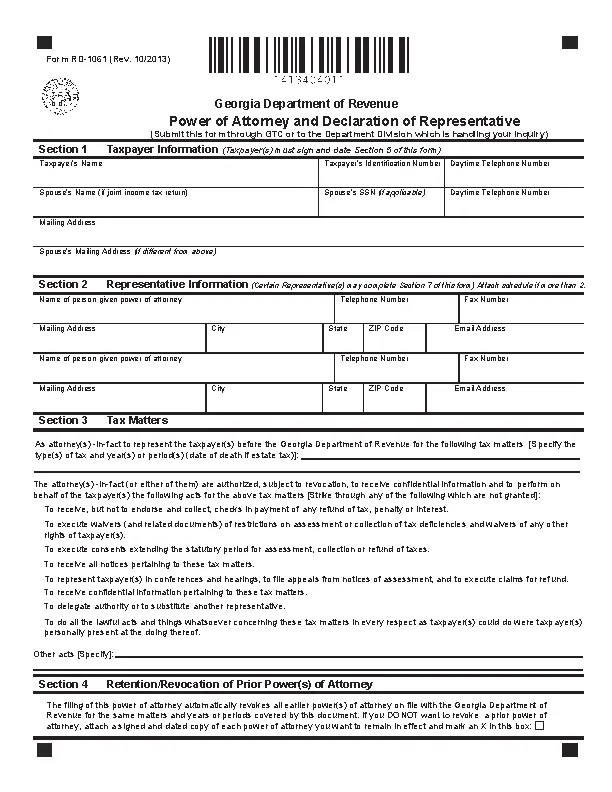

Georgia Tax Power Of Attorney Form 1 Pdfsimpli

4 Reasons Why Estate Planning Is Important Goldberg Associates

Atlanta Estate Tax Lawyer Ga Inheritance Litigation Lawyer

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Georgia Probate Access Your Georgia Inheritance Immediately

Proposed Legislative Impacts On Estate Tax And Succession Planning Georgia Fruit And Vegetable Growers Association

Does Georgia Have Inheritance Tax